Lately the conversation around retirement savings has gained new urgency. According to a survey by AARP, 20% of Americans aged 50 or more have no retirement savings, while 61% of these same Americans are worried they won't have enough money to support themselves in retirement.

In response to this savings shortfall, many states are passing legislation requiring private businesses to offer retirement plans to their employees. Knowing if you are impacted, and how, is a critical step in remaining compliant and avoiding costly penalties. Here is what you need to know.

What is a state-mandated retirement plan?

A state-mandated retirement plan is a retirement savings program established by a state that requires certain private employers to provide employees with access to a retirement savings option. Employers can choose to either enroll employees in a state-sponsored plan or a qualifying private option.

State-sponsored plans vary by state, but typically leverage an individual retirement account (IRA), where employees can opt out or determine how much they want to contribute. Employers are responsible for offering the plan and ensuring employee contributions are taken out of paychecks. More often than not, employers aren't permitted to contribute to state plans. But there are exceptions, like in Massachusetts, where employers can contribute a certain amount for particular plans.

If you currently offer your employees a private retirement plan option, you may already satisfy state requirements. Qualifying private plans vary by state, but typically include 401(k)s, SIMPLE IRAs, qualified annuity plans, Simplified Employee Pension plans and more. Before assuming your plan qualifies, check your state requirements.

Important: If you are a private business and have employees who reside in or report income in a state with a retirement plan mandate, you may need to meet those state requirements.

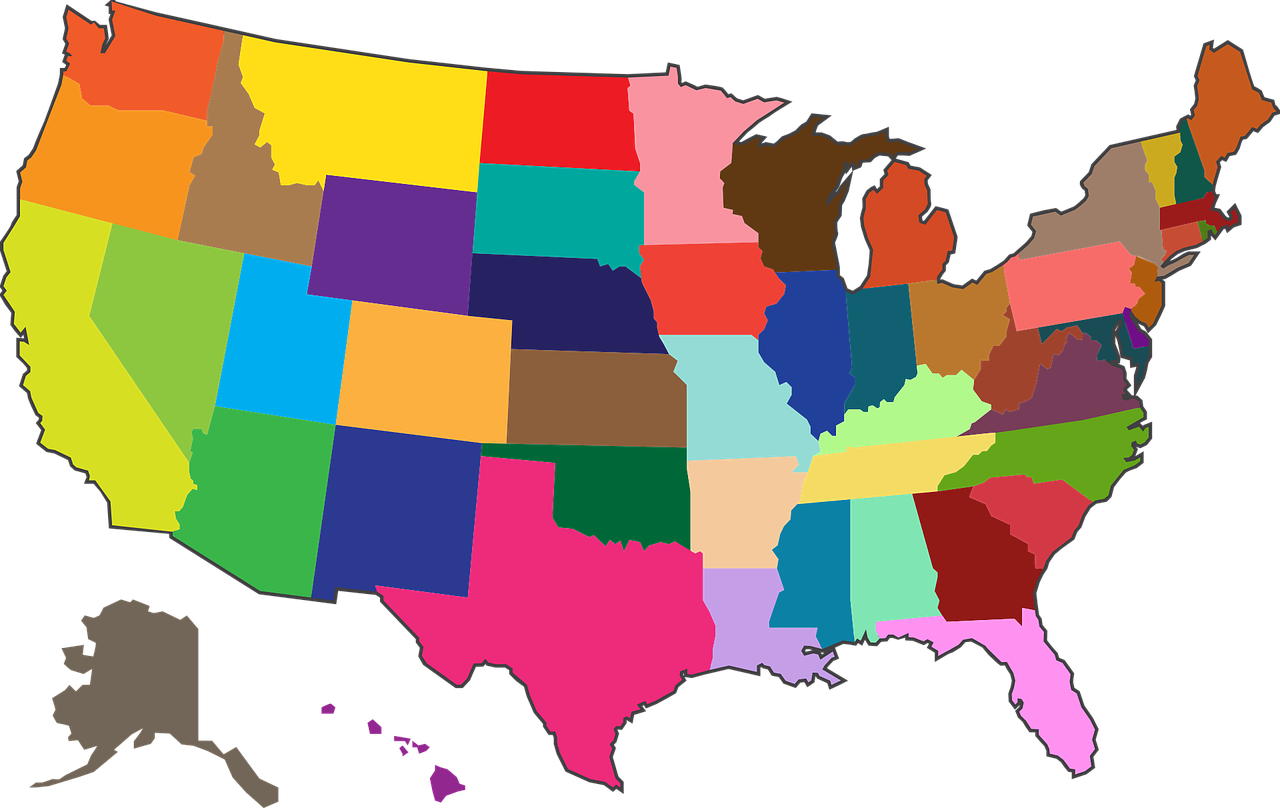

Which states require employers to offer a qualifying retirement plan?

Below is a list of states that have either implemented or are in the process of rolling out mandatory retirement savings programs. Within this list are a few states with asterisks indicating that their programs are voluntary or no longer active.

Employers have state-dictated deadlines to enroll in the state-sponsored plan or to certify that they already offer a qualifying retirement plan. Failure to meet these deadlines may result in penalties ranging from hundreds to thousands of dollars, so be sure to review state requirements in their entirety.

Chart Last Updated: 11.26.25

| State | Program Name | Program Status |

| California | CalSavers | Active |

| Colorado | Colorado SecureSavings | Active |

| Connecticut | MyCTSavings | Active |

| Delaware | DE Earns | Active |

| Hawaii | Hawaii Retirement Savings Program | Implementation in progress (projected launch mid-2026) |

| Illinois | Illinois Secure Choice | Active |

| Maine | Maine Retirement Investment Trust (MERIT) | Active |

| Maryland | MarylandSaves | Active |

| Massachusetts | Massachusetts CORE Plan | Active for nonprofits |

| Minnesota | Secure Choice Retirement Program | Jan. 1, 2026 - launch for voluntary coverage Phased launch for mandatory coverage starting April 1, 2026. |

| Missouri* | Show-Me MyRetirement Savings Plan | Active (Voluntary) |

| Nevada | Nevada Employee Savings Trust (NEST) | Active |

| New Jersey | RetireReady NJ | Active |

| New Mexico | Page is no longer live | Inactive (2025) |

| New York | New York Secure Choice Savings Program | Active |

| Oregon | OregonSaves |

Active |

| Rhode Island | Rhode Island Savers | Active |

| Vermont | Vermont Saves | Active |

| Virginia | RetirePath VA | Active |

| Washington | Washington Saves | Implementation in progress (projected launch in 2027) |

Deciding between a state-provided and private retirement plan

Employers who are are required by state mandates to offer a retirement plan must decide between a state-sponsored plan or a qualifying private option. Depending on your goals, there are positives and negatives to both:

State-sponsored plan make sense if you:

- Are a small businesses that wants to avoid plan administration or fiduciary responsibility

- Are not ready to commit to match contributions

- Only have the goal of compliance, and employee appeal is not a priority at this point

- Do not care about plan flexibility or control over investment options

A qualifying private plan like a 401(k) makes sense if you:

- Want to attract and retain talent through employer match

- Are seeking larger pre-tax contributions and business deductions

- Prefer to control investment options and want a more flexible plan design

- Want to take advantage of possible tax credit benefits

Need help navigating whether a state or private plan is right for you? Contact our team and we will put you in touch with a trusted third-party advisor that will help you determine the best path forward (with no consultation costs involved!).

How to make offering a retirement savings program easier

Whether you offer a state-provided retirement plan or a private option, there are ways to make managing it easier. A lot of the data and administration will be handled directly through the provider's portal but you'll also want to take a look at your human capital management (HCM) solution to ensure you are leveraging its capabilities to the fullest.

For example, a robust system, like UKG Ready, will support you and your retirement plan offering in the following ways and more:

- Plan definition: Set up plan details like eligibility, deduction amounts, contribution limits, matching rules and enrollment dates within the same system you use to manage your full benefits package.

- Payroll deductions: Automatically take employee contribution amounts out of employee paychecks and calculate/display employer contributions on paycheck stubs.

- Data sharing: Automatically and securely pass employee and employer contribution amounts to retirement plan providers after a payroll run. In many cases, 360-degree or two-way data sharing between provider and HCM technology will also be available!

- Total compensation: Get the full picture with total compensation data that accounts for everything from salary to employer paid benefits like retirement contribution amounts, taxes, paid time off and more.

- Company Hub: Leverage a handy, customizable dashboard as a one-stop location for employees to get helpful information, including a link to your retirement plan provider's portal, so they can quickly adjust contribution amounts or opt-out of your provided plan.

Interested in learning more about how B2E Solutions and our HCM solution can help? Contact us today.

Editor's Note: This blog is regularly updated to ensure it contains the most up-to-date information possible.