The first signs of spring include flowers blooming, the start of baseball season and employees inquiring about their tax withholdings. Although employers don’t submit W-4 forms directly to the IRS, the way employees complete these forms, and the year in which they did so, can have an effect on your payroll.

It is normal to expect a few W-4 form tweaks year over year. 2025 is no different. So, for new hires or employees who need to update their withholdings or exemption status, this year’s changes are minimal compared to the W-4 overhaul that began in 2019 and eventually took hold on the 2020 form — which continues to have implications to this day.

As tempting as it might be to do a little spring cleaning and get everybody to complete the most current W-4 form, as employers, you cannot typically require existing employees to fill out a new W-4 form. However, we say that loosely.

If an employee claims exempt, they must submit a new W-4 by Feb. 15th of the following year. If a W-4 is invalidated for any reason (e.g., crossed out verbiage), you must require a new one. If either of these situations occur and the employee does not submit a new form, you are required to withhold federal income tax at the highest rate, which is usually Single and no other deductions.

Outside of invalidation, it’s best practice to remind employees to check their withholding a few times a year, especially after life changes like marriage, a new child or maintaining multiple jobs.

Now that you have a little background, let’s dive in. Here's an easy breakdown of what to expect on the newest W-4 form so that you can help employees improve withholding accuracy and simplify calculations.

2025 W-4 changes

The 2025 version of the W-4 form has undergone minor changes. Two notable updates to the 2025 W-4 form are:

- There is a new tip encouraging employees to use the IRS's Tax Withholding Estimator for determining accurate withholding amounts. This tool is especially helpful for employees (or their spouses) who have self-employment income.

- Per usual, the updates to the “Deductions Worksheet” reflect the latest tax law changes. Specifically, the worksheet reflects tax inflation adjustments, as the IRS increased standard deduction amounts.

While the 2025 W-4 form changes were minimal, it is worthwhile to keep in mind that the implications of the 2020 form overhaul still have implications for today. Understanding what those are will ensure that you understand how employees should properly fill out their W-4s moving forward.

The importance of the 2020 W-4 form in 2025

When the Tax Cuts and Jobs Act (TCJA) passed in December 2017, reverberations were sent through the tax code, some of which can still be felt today. Ostensibly, the TCJA was aimed at helping taxpayers improve the accuracy of their withholding. This led to a redesign of the W-4 form itself.

This meant that payroll and HR departments had to adapt to the new W-4 form while maintaining a stable of employees who had filled out a prior year’s version. Today is no different. Just because there is a newer form available, you likely have employee W-4s on file that predate 2020 too. Understanding how pre-2020 and post-2020 W-4s are different will help you move more quickly when reviewing either "generation" of forms, identify issues and ensure your payroll is accurately aligned with employee W-4s.

To gain a better understanding of the change, here are the major differences payroll departments should note about the newer W-4 form. Now, when you come across W-4 forms that predate 2020, you can confidently compare apples to oranges.

Eliminated withholding allowances

This is the most fundamental difference between W-4 forms after 2020 and those from years prior to that. TCJA no longer allows personal and dependency allowances. As such, employees can no longer claim withholding allowances for oneself, a spouse or children to lower their federal income tax withholding.

Now, the W-4 form asks for more direct information. Instead of choosing a number of allowances like before, the current W-4 form asks employees to fill in specific details such as income from the employee’s job with you or other jobs, dependents and tax deductions (like for student loan interest or mortgage interest).

With this more direct information, the IRS can figure out more precisely how much tax should be taken out of each paycheck.

Side note: Since allowances are no longer used to calculate withholding, the IRS removed “allowance” from the form title so it reads “Employee’s Withholding Certificate” instead of “Employee’s Withholding Allowance Certificate.”

Introduced a simpler five-step withholding calculation format

The IRS certainly achieved its ease-of-use goal by streamlining the withholding calculations. With the post-2020 W-4, we said goodbye to complicated worksheets. Instead, the form uses straightforward questions divided into five steps. That said, employees only need to complete Steps 1 and 5. Steps 2 - 4 are optional based on individual situations.

Here’s the breakdown, with images showing what each step looks like now:

1. Enter Personal Information: This one’s pretty straightforward and one of the obligatory steps we mentioned above.

2. Multiple Jobs or Spouse Works: If an employee works multiple jobs or the employee and their spouse both work, this section is used to increase withholding and reduce tax liability come tax return time.

3. Claim Dependent and Other Credits: Employees can claim dependents and/or enter specially qualified education, childcare or savings deductions in this step.

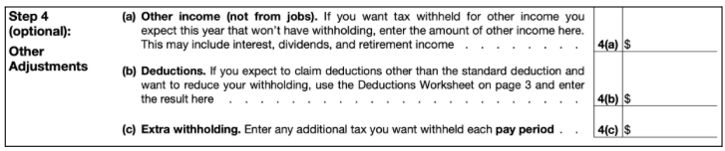

4. Other Adjustments: Employees can use this step to request additional withholding for any other income they may have that isn’t automatically subject to withholding, such as self-employment income, rental income or interest.

5. Sign Here: Required for all.

Changed line numbers and worksheets

This is an important head’s up for payroll and HR veterans who could review a pre-2020 W-4 form in their sleep.

Prior to the 2020 W-4 changes, the W-4 had specific line numbers for different calculations. Be careful. On any W-4 version from 2020 through now, some of those numbers have changed, with specific calculations moving to separate worksheets.

Speaking of worksheets, IRS Publication 15-T has all the federal income tax withholding methods in one place. This singular resource helps both employers who calculate payroll by hand and those who utilize what the IRS refers to as “automated payroll systems” — which includes technology like the UKG Ready payroll solution we offer.

If you are performing payroll manually, employees will fall into one of four Tables in IRS Publication 15-T, depending on which year’s version of a W-4 form they completed. If calculating withholding manually, make sure to be always use the same Table for consistency.

Bottom line: Because the IRS changed the worksheets and updated the percentage method tables, the 2020 W-4 changes help payroll systems do a better job withholding just the right amount of tax from paychecks.

You can consult this chart to see state-by-state W-4 requirements.

How to make W-4 forms easier for everyone

As a payroll or HR professional, you are an important resource for your employees. While W-4 forms are much more streamlined nowadays, they’re still not foolproof. You may still need to gently guide your employees. To ensure you provide the right kind of advice (without overstepping), we recommend you check out our dedicated blog on the topic.

Also, if you aren’t already, it is a good idea to leverage electronic W-4s through your payroll processing system's provider. Employees don’t want to deal with cumbersome W-4 PDFs that are tough to update, save and submit (we’ve all been there). It’s far easier when an employee can simply log in to the payroll system, fill out an electronic W-4 using a guided widget and ensure their W-4 is saved in the system. Plus, it’s easier for you too. You always have the most recent W-4 on file, and your payroll will be more accurate because employee W-4 information is in the system and will automatically inform employee withholdings on each and every payroll run.

If you’re not already taking advantage of online W-4 processing, check out our Human Resources solution or contact us today.

.png)