In Orbit Solutions, employees of our Payroll clients have the ability to update W-4 withholding forms electronically. If an employee has a baby, for example, that employee can update his or her own W-4 in Orbit Solutions.

To help you and your employees use Electronic W-4s, Payroll Data has outlined a simple process:

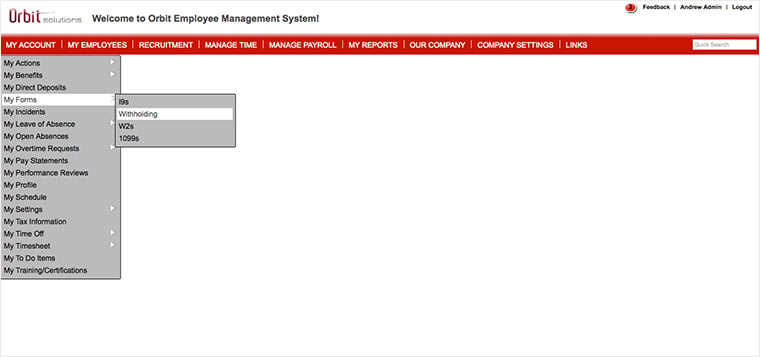

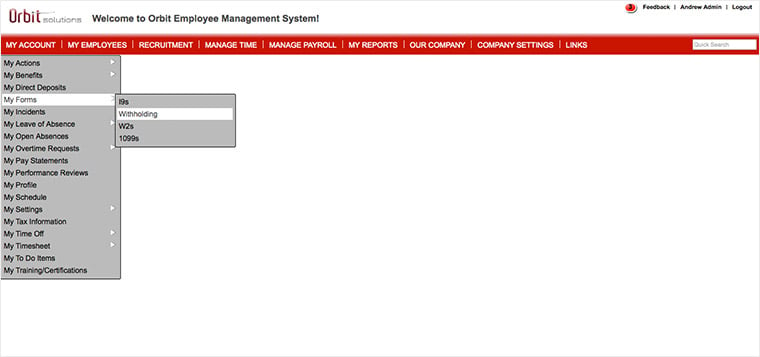

1. Navigate to My Account > My Forms > Withholding.

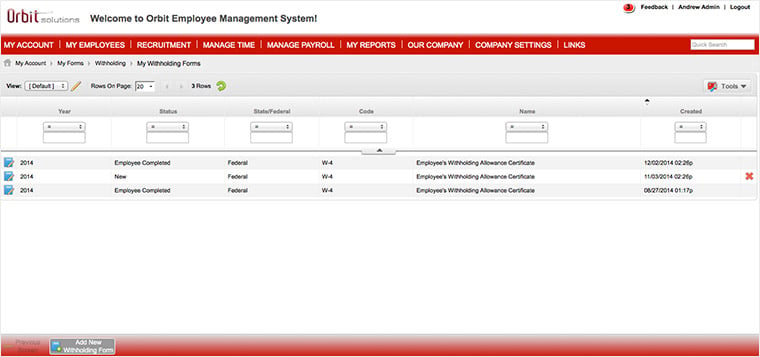

2. Select Add New Withholding Form in the lower-left corner.

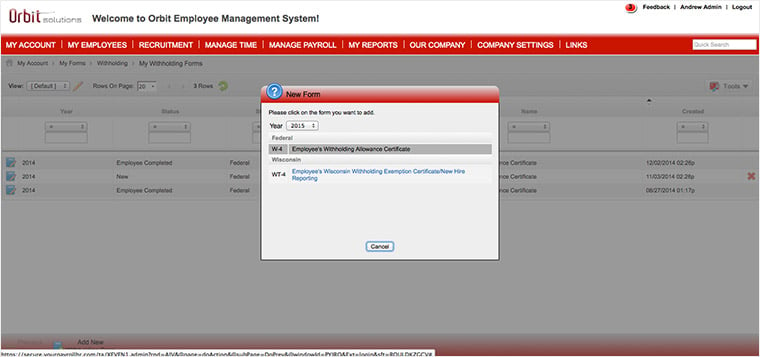

3. Select the Federal W-4 form.

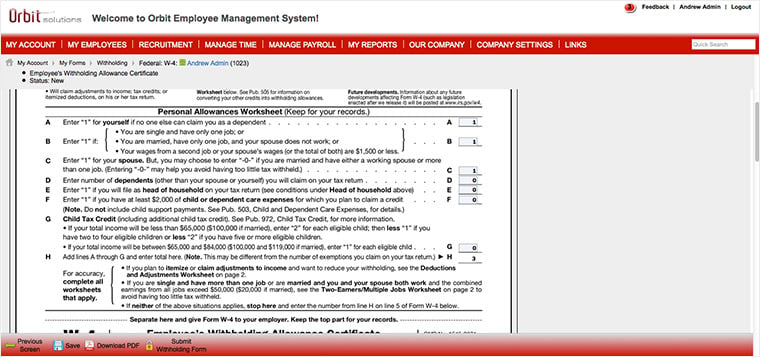

4. Complete the Personal Allowances Worksheet.

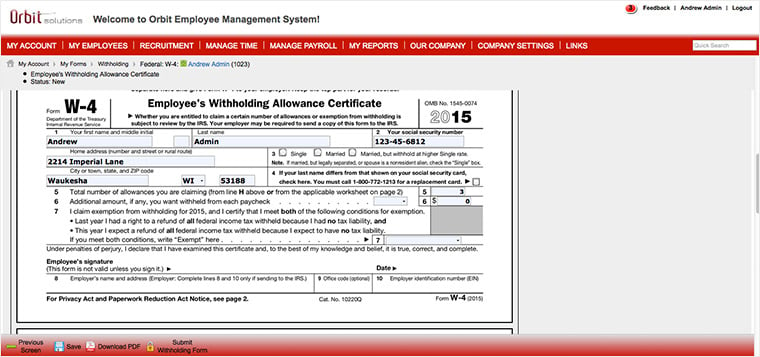

5. Confirm any information that’s in the W-4.

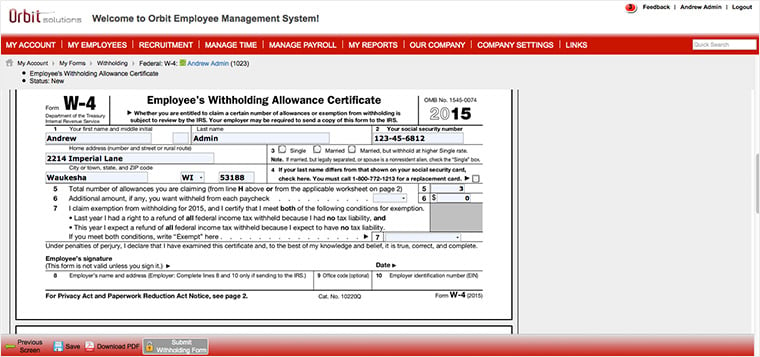

6. Select Submit Withholding Form.

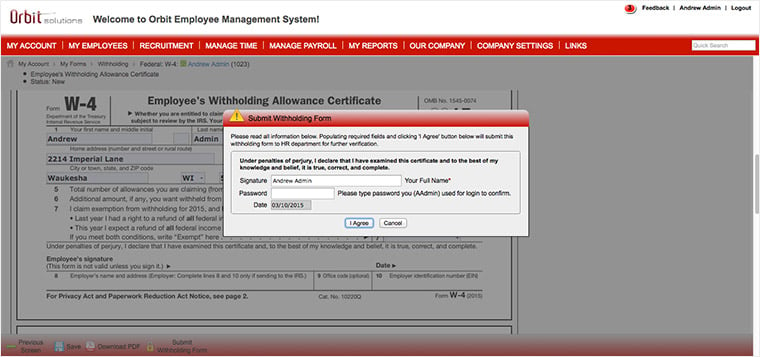

7. Sign the W-4 electronically.

8. Done! Orbit will notify the payroll administrator and, once approved, updates automatically flow through and update the employee's tax settings with no manual edits needed.

If you’re using paper W-4s, consider a transition to electronic W-4s to…

…free up HR/Payroll’s valuable time.

…empower employees.

…move your company to paperless recordkeeping.

If you have any questions about using electronic W-4s, please contact your CSR.