If you have questions when it comes to Health Savings Accounts (HSAs), you’re not alone. HSAs come with significant benefits, including tax advantages, but to make the most of them, you need to be clear on the rules. With a new tax year underway (and new HSA contribution limits), now’s the perfect time for an HSA refresher. To help you out, we’ve compiled answers to the top ten most commonly asked HSA questions. Check them out!

1) What is an HSA?

First, let’s start with the basics. An HSA is a pre-tax savings account for individuals with high deductible health insurance plans (HDHP). People with HSA plans can set aside pre-tax dollars to pay for out-of-pocket medical expenses.

2) What expenses does an HSA cover?

HSAs cover a wide range of qualified medical expenses, including doctor visits, prescriptions, deductibles, medical equipment, and dental and vision care. Since HSAs are tax-deductible, the IRS defines which medical expenses are covered. You can find a comprehensive list of those here.

3) How does an HSA work?

If you’re an employer offering HDHP health insurance coverage, you can set up payroll deductions for your employees’ HSA contributions. This allows them to easily contribute a portion of each paycheck directly into their HSA accounts, which can be used to pay for qualified medical expenses. These contributions don’t count as taxable income, so it means immediate tax savings for employees.

4) Who can contribute to an HSA?

While employees technically own their HSA accounts, both employees and employers can make contributions. Family members or any other person can also make contributions on behalf of an eligible individual. If you’re an employer that’s making contributions, keep in mind that those count toward your employee’s HSA limit, so make sure the total combined contributions do not exceed the HSA limit established by the IRS.

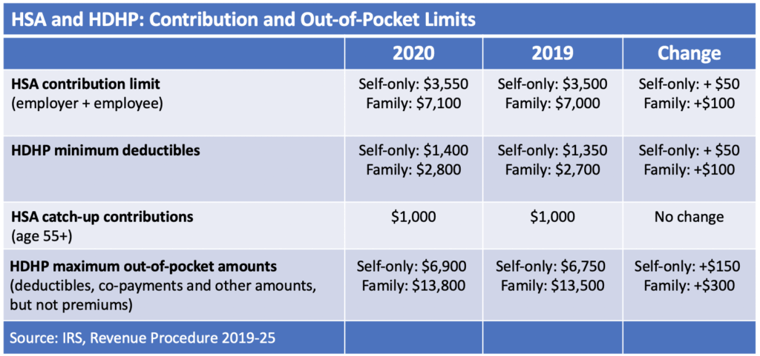

5) What are the HSA contribution and out-of-pocket limits?

Since HSAs have significant tax advantages, the IRS sets new contribution and out-of-pocket limits every year. These limits are adjusted for annual inflation, but the catch-up contribution amount is fixed. The below chart summarizes what you need to know for 2019 and 2020. Please note, these rates could change again throughout the year. If you're already a Payroll Data customer, we'll issue this information in our Year-End Payroll Guide. You can also follow us on LinkedIn and Facebook to ensure you don't miss important updates like these!

6) What are the tax benefits of an HSA?

Cash contributions to an HSA are 100 percent deductible from federal gross income. If employees make withdrawals from the HSA for qualified medical expenses, they’re tax-free. HSAs also reduce employer payroll taxes. Win-win!

7) Can you change your HSA contribution amount?

Yes, under an HSA “cafeteria plan,” employees can start, stop or change their HSA contribution amount at any time during the plan year. Employer cafeteria plans must meet specific requirements and regulations of the IRS section 125, which provides participants an opportunity to receive benefits on a pre-tax basis.

8) What happens if employees put too much money in an HSA?

Employees must avoid this scenario at all costs. HSA contributions in excess of the IRS limits are not tax deductible. They’re also subject to a six percent excise tax, or a flat-rate tax that applies to goods, services and activities.

If your employees find themselves in this situation, there are two things they can do:

- Remove the excess contributions before they file their federal income tax return. However, they’ll pay income taxes on the excess removed from their HSA.

- Leave the excess contributions in their HSA and pay the six percent excise tax on excess contributions. If they go this route, they’ll likely want to reduce their contributions for the following year to make up for excess contributions.

If your employees are contributing to their HSA automatically through payroll deductions, it’s important to put safeguards in place to prevent them from over-contributing. If you’re using Orbit Payroll, for example, we have system parameters in place to ensure HSA contributions stay within limits.

9) What happens to money in an HSA account at the end of the year?

With HSAs, there’s no “use it or lose it” policy — the money in an HSA account rolls over from year to year. Unused contributions will keep accumulating until employees need them, and even better, the balances earn interest.

10) What are the advantages for an employer to offer an HSA?

Since HSAs are paired with HDHPs, they can result in significant savings for employers. How? HDHPs come with lower insurance premiums. Some employers may choose to contribute those savings to employees’ HSA plans, and those contributions are tax deductible.

We’re here to help.

HSAs can be complex, but with automatic payroll deductions and contribution caps in place, Orbit Payroll makes it easier. To find out more about how we can simplify and streamline your payroll process, check out Orbit Payroll now. Or, if you’re already using Orbit Payroll, contact your client service representative (CSR) to ensure you’re taking advantage of all the latest and greatest capabilities!